India Market Analysis: Nifty's Strong Performance And Market Indicators

Table of Contents

Nifty 50 Index Performance Analysis

Recent Trends and Growth Drivers

The Nifty 50 index has demonstrated remarkable resilience and growth over the past [Insert timeframe, e.g., year/quarter]. This positive trajectory can be attributed to several key factors. We've witnessed periods of significant upward momentum, punctuated by minor corrections. For instance, [Insert specific example of growth period, e.g., "the index saw a 15% increase between X and Y due to..."].

- Foreign Institutional Investor (FII) Investments: Substantial FII inflows have significantly contributed to the Nifty's rise, reflecting a positive outlook on the Indian economy.

- Robust Domestic Consumption: A surge in domestic consumption, fueled by [mention factors like rising disposable income or specific consumer trends], has boosted corporate earnings and market sentiment.

- Government Policies: Favorable government policies focused on [mention specific policies like infrastructure development or ease of doing business] have created a conducive environment for business growth.

[Insert relevant chart/graph visualizing Nifty 50 performance over the specified timeframe]. The market capitalization of the Nifty 50 has also experienced considerable expansion, further underscoring the strong performance of the Indian stock market.

Sector-wise Performance

Analyzing the Nifty 50's performance on a sector-by-sector basis reveals interesting insights.

- Top Performers: The IT sector has consistently outperformed other sectors, driven by strong global demand and a skilled workforce. The banking sector also showed robust growth due to [mention reasons like increased credit growth or government initiatives].

- Underperformers: Certain sectors, such as [mention specific underperforming sectors and briefly explain the reasons]. However, this is often a cyclical trend, and these sectors are expected to recover as market conditions improve.

This sectoral analysis highlights the diverse nature of the Indian economy and its ability to sustain growth even amidst global uncertainties. Keywords: Nifty Bank, Nifty IT, FMCG stocks, India sectoral performance.

Volatility and Risk Assessment

While the Nifty 50 has exhibited strong growth, it's crucial to acknowledge the inherent volatility of the market.

- Global Economic Uncertainty: Global economic slowdowns or geopolitical events can impact investor sentiment and trigger market corrections.

- Inflationary Pressures: High inflation rates can erode purchasing power and negatively affect corporate profitability.

- Geopolitical Risks: Geopolitical instability in the region or globally can create uncertainty and volatility in the market.

Effective risk management strategies, such as diversification, hedging, and stop-loss orders, are crucial for mitigating these risks and protecting investment portfolios. Keywords: Market volatility, risk management, investment strategies, India market risks.

Key Market Indicators

Economic Indicators

Several key economic indicators significantly influence the Nifty 50's performance.

- GDP Growth Rate: A robust GDP growth rate generally reflects a healthy economy, boosting investor confidence and driving stock market performance.

- Inflation: High inflation can negatively impact market sentiment, whereas controlled inflation fosters a more stable investment environment.

- Rupee Exchange Rate: The rupee's value against other major currencies influences FII investments and the overall performance of the market.

Analyzing these economic indicators provides crucial insights into the underlying health of the Indian economy and its potential impact on the stock market. Keywords: GDP growth rate, inflation, rupee exchange rate, economic indicators India.

Market Sentiment and Investor Confidence

Investor sentiment and confidence play a vital role in shaping market trends.

- Positive News Events: Positive news, such as favorable policy announcements or strong corporate earnings, can boost investor confidence and drive market growth.

- FII/DII Investments: Significant FII and DII investments indicate a positive outlook on the Indian market, whereas withdrawals reflect concerns and uncertainty.

- Global Market Trends: Global market trends, such as fluctuations in global indices, can have a ripple effect on the Indian market.

Monitoring investor sentiment through surveys and market reports provides valuable insights into market dynamics and potential future trends. Keywords: Investor sentiment, market confidence, FII investment, DII investment, market psychology.

Interest Rate Scenarios and their Impact

Interest rate changes implemented by the Reserve Bank of India (RBI) have a direct impact on the Nifty 50.

- Monetary Policy: The RBI's monetary policy decisions, such as changes in repo rates, influence borrowing costs for businesses and affect stock valuations.

- Impact on Stock Valuations: Higher interest rates generally lead to lower stock valuations, as investors seek higher returns from fixed-income investments. Lower interest rates can stimulate economic activity and boost stock prices.

Understanding the RBI's monetary policy and its potential implications is crucial for navigating the complexities of the Indian stock market. Keywords: Interest rate policy, Reserve Bank of India (RBI), monetary policy, impact of interest rates.

Conclusion: India Market Analysis: Nifty's Strong Performance and Market Indicators

This India Market Analysis highlights the Nifty 50's impressive performance, driven by robust economic growth, positive investor sentiment, and supportive government policies. However, it's essential to consider the inherent market volatility and the influence of various economic and geopolitical factors. Key takeaways include the importance of monitoring key economic indicators, understanding investor sentiment, and acknowledging the impact of interest rate changes.

Stay informed about the dynamic Indian market and continue your India Market Analysis to make informed investment decisions. Conduct further research using the insights provided here and consult with financial advisors for personalized guidance.

Featured Posts

-

Gambling On Catastrophe The Los Angeles Wildfire Betting Market

Apr 24, 2025

Gambling On Catastrophe The Los Angeles Wildfire Betting Market

Apr 24, 2025 -

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

Apr 24, 2025

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

Apr 24, 2025 -

Is Sk Hynix The New Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025

Is Sk Hynix The New Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Allegations

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Allegations

Apr 24, 2025 -

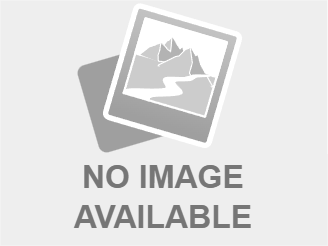

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

Apr 24, 2025