High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's recent valuation reports paint a detailed picture of the current equity market. Their analyses utilize several key metrics to assess the health and potential risks associated with these high stock market valuations. Understanding their methodology is crucial for interpreting their findings and forming your own investment strategy.

-

BofA's Valuation Methodology: BofA employs a multifaceted approach, combining fundamental analysis with a review of market sentiment and macroeconomic factors. This involves assessing various stock valuation metrics, comparing them to historical data, and considering the overall economic climate.

-

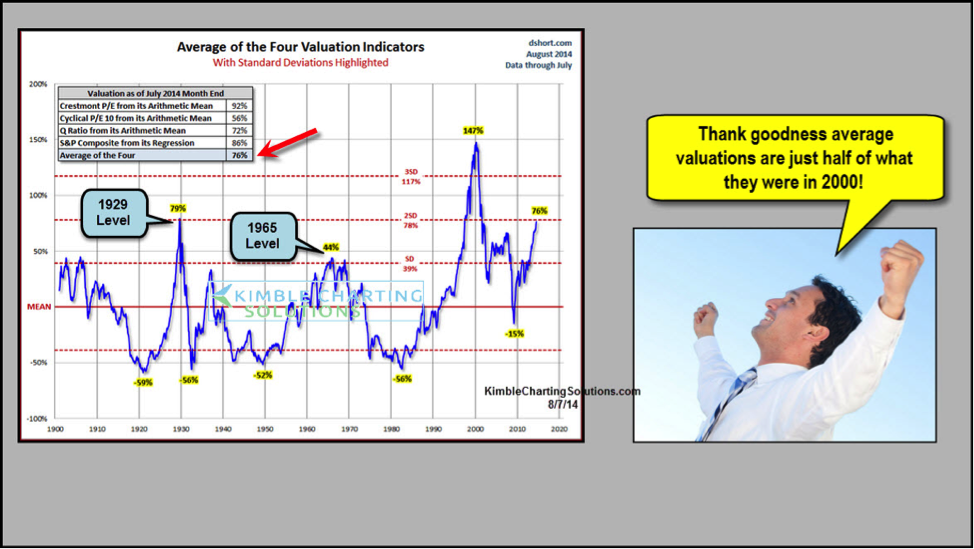

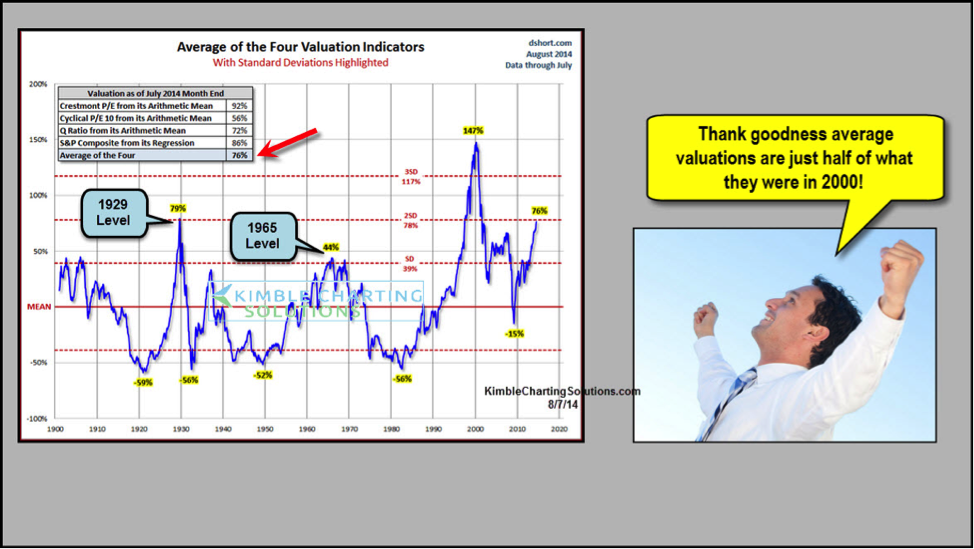

Key Metrics Used: BofA's analysis relies on several critical metrics, including the Price-to-Earnings ratio (P/E), the Shiller P/E (CAPE ratio, which accounts for inflation-adjusted earnings over ten years), and market capitalization relative to GDP. These provide a comprehensive view of equity market valuations.

-

Specific Valuations Found: While specific numbers vary based on the report and time of release, BofA's analyses often indicate that certain sectors or the overall market are trading at premiums compared to historical averages. For example, a recent report might suggest that the S&P 500 is X% overvalued based on their chosen metrics. These findings are regularly updated, so staying current on BofA's publications is essential.

-

Comparison to Historical Valuations: BofA's reports frequently compare current valuations to those observed during previous market cycles. This historical context helps investors understand whether current valuations are exceptionally high compared to long-term trends. This historical perspective is crucial for discerning whether current prices reflect sustainable growth or represent a bubble.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the elevated stock market valuations we are currently witnessing. Understanding these underlying forces is critical for making informed investment decisions.

-

Impact of Low Interest Rates: Low interest rates, a common monetary policy tool, make borrowing cheaper for companies and can stimulate investment, ultimately driving up stock prices. Low discount rates used in discounted cash flow (DCF) valuations also increase present values of future cash flows, pushing up valuations.

-

Influence of Inflation on Corporate Profits: Inflation can impact corporate profits and subsequently influence stock prices. While inflation can sometimes lead to higher prices and revenue, it can also squeeze profit margins if costs rise faster than prices. BofA's analyses often consider the interplay between inflation and corporate earnings.

-

Role of Economic Growth Forecasts: Market sentiment is heavily influenced by the outlook for future economic growth. Positive growth forecasts tend to support higher stock valuations as investors anticipate increased corporate earnings. BofA closely monitors economic indicators to incorporate these forecasts into their valuation models.

-

Effect of Quantitative Easing (QE): QE involves central banks injecting liquidity into the market by purchasing assets. This increased money supply can fuel asset price inflation, including stocks, contributing to high stock market valuations. BofA's analysis takes into account the impact of past QE programs and their potential effects on future valuations.

Investor Reassurance and Mitigation Strategies

Navigating high stock market valuations requires a thoughtful and cautious approach. Investors can employ several strategies to manage risk and protect their portfolios.

-

Importance of a Diversified Investment Portfolio: Diversification remains a cornerstone of sound investment strategy. By spreading investments across different asset classes (stocks, bonds, real estate, etc.), investors can reduce their overall risk exposure.

-

Strategies for Long-Term Investing: A long-term investment horizon is crucial in mitigating short-term market volatility. Focusing on the long-term growth potential of assets can help investors weather fluctuations in the market.

-

Defensive Investment Options: During periods of high valuations, investors may consider allocating more to defensive investment options, such as high-quality bonds or dividend-paying stocks. These assets tend to offer greater stability compared to growth stocks.

-

Adjusting Asset Allocation Based on Risk Tolerance: Investors should regularly review and adjust their asset allocation to align with their personal risk tolerance and financial goals. A financial advisor can assist in creating a personalized plan.

-

Considering Value Investing Strategies: Value investing involves identifying undervalued stocks with the potential for future growth. In markets with high valuations, finding value can be challenging but potentially rewarding.

-

Understanding Growth vs. Value Investing: The choice between growth and value investing depends on individual risk tolerance and market conditions. Growth stocks often trade at higher valuations reflecting expectations of faster growth, while value stocks may offer lower valuations but potentially steadier returns.

Alternative Investment Opportunities Beyond Equities

Diversification beyond equities can offer protection during periods of high equity valuations. Exploring alternative investment classes can offer potentially attractive risk-adjusted returns.

-

Bonds: While interest rate changes affect bond prices, they can still offer a degree of stability and diversification in a portfolio. BofA’s analysis of the fixed-income market should be considered when deciding on bond allocation.

-

Real Estate Investment Trusts (REITs): REITs can offer exposure to the real estate market, potentially providing diversification and income generation.

-

Other Alternative Asset Classes: Alternative investments such as private equity, hedge funds, and commodities offer further diversification but often come with higher risks and illiquidity.

Conclusion

BofA's analysis highlights the elevated nature of current stock market valuations, driven by factors such as low interest rates, inflation, and economic growth forecasts. While high valuations present potential risks, investors can mitigate these by implementing prudent strategies. Diversification, long-term investing, adjusting asset allocation based on risk tolerance, and considering alternative investment opportunities are all vital components of navigating this environment. Conduct thorough research, consult with a financial advisor, and develop a well-informed investment strategy to effectively manage the challenges presented by high stock market valuations. Remember to regularly review and adjust your investment plan based on BofA's ongoing analysis and market fluctuations. Understanding and responding to high stock market valuations is crucial for long-term investment success.

Featured Posts

-

Emerging Market Stocks Outperform Us Year To Date Gains Explained

Apr 24, 2025

Emerging Market Stocks Outperform Us Year To Date Gains Explained

Apr 24, 2025 -

Trump Administration Immigration Crackdown Mounting Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Mounting Legal Challenges

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Odrastanje U Zvijezdu

Apr 24, 2025

Ella Travolta Kci Johna Travolte Odrastanje U Zvijezdu

Apr 24, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 24, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 24, 2025 -

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

Apr 24, 2025