Understanding Stock Market Valuations: Why BofA Remains Optimistic

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

Bank of America maintains a bullish stance on stock market valuations, projecting continued, albeit moderate, growth in the coming years. Their reasoning rests on several key economic indicators.

- Strong Corporate Earnings: BofA points to robust corporate earnings reports across various sectors as a primary driver of their optimism. Many companies have exceeded expectations, demonstrating resilience in the face of economic headwinds.

- Low Unemployment Rates: Persistently low unemployment figures indicate a strong labor market, fueling consumer spending and supporting economic growth, which positively impacts stock valuations.

- Undervalued Sectors: BofA identifies specific sectors, such as technology and certain segments of the consumer discretionary market, as potentially undervalued and ripe for future growth. Their analysis suggests these sectors are poised for a rebound.

- Projected Market Returns: BofA's analysts predict moderate but consistent market returns over the next 12-18 months, with specific projections varying depending on the chosen investment strategy and risk tolerance. (Note: Specific numerical projections would be included here if available from a credible BofA source).

Key Factors Influencing Stock Market Valuations

Several fundamental factors interact to determine stock prices and influence stock market valuations. Understanding these factors is essential for informed investment decisions.

- Price-to-Earnings Ratio (P/E): The P/E ratio is a crucial valuation metric, comparing a company's stock price to its earnings per share. A high P/E ratio can suggest that a stock is overvalued, while a low P/E ratio might signal undervaluation. However, P/E ratios should be interpreted within the context of industry benchmarks and growth prospects.

- Interest Rates: Interest rate fluctuations significantly impact stock valuations. Rising interest rates generally lead to higher borrowing costs for companies, potentially slowing growth and reducing stock prices. Conversely, lower interest rates can stimulate investment and boost valuations.

- Inflation and Economic Growth: Inflation and economic growth are intrinsically linked to stock market valuations. High inflation erodes purchasing power and can dampen investor confidence, while robust economic growth typically supports higher stock prices. The interplay between these two factors is complex and requires careful consideration.

- Investor Sentiment and Market Psychology: Market psychology and investor sentiment play a crucial, albeit unpredictable, role in determining stock market valuations. Periods of heightened fear or excessive optimism can lead to dramatic price swings, regardless of underlying fundamentals.

Understanding Valuation Discrepancies: BofA vs. Other Analysts

While BofA holds a relatively optimistic view on stock market valuations, other financial institutions and analysts offer differing perspectives. Some analysts express concerns about persistent inflation, rising interest rates, and potential economic slowdowns, leading them to adopt more cautious outlooks.

- Opposing Viewpoints: Some analysts predict a more significant market correction, citing concerns about overvalued assets and potential economic risks. Their arguments often focus on potential future interest rate hikes and their impact on corporate profitability.

- Areas of Disagreement: Key areas of disagreement often center around the projected pace of economic growth, the effectiveness of central bank policies in managing inflation, and the overall risk tolerance of investors.

- Discrepancies in Projections: Divergences exist in projected growth rates, with some analysts forecasting significantly lower returns compared to BofA's projections. These differences reflect varying interpretations of economic data and differing analytical methodologies.

Strategies for Navigating Uncertain Stock Market Valuations

Navigating uncertain stock market valuations requires a well-defined investment strategy that accounts for both potential opportunities and risks.

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is a fundamental risk mitigation strategy. Spreading your investments reduces your exposure to losses in any single asset class.

- Investment Approaches: Consider your risk tolerance when choosing an investment approach. Value investing focuses on identifying undervalued stocks, while growth investing targets companies with high growth potential. A balanced approach might be suitable for many investors.

- Long-Term Investing: Maintaining a long-term investment horizon is crucial, as short-term market fluctuations are less impactful on long-term returns. Avoid panic selling based on short-term market volatility.

- Seek Professional Advice: Consult with a qualified financial advisor to develop a personalized investment strategy tailored to your specific financial goals, risk tolerance, and time horizon.

Conclusion

In conclusion, while BofA maintains a relatively optimistic outlook on stock market valuations, supported by strong corporate earnings and low unemployment, other analysts offer more cautious assessments. Understanding these contrasting perspectives and the key factors influencing valuations—including P/E ratios, interest rates, inflation, and investor sentiment—is crucial. Understanding stock market valuations is paramount for making informed investment decisions. Conduct further research, consider various viewpoints, and, most importantly, develop a well-informed strategy that aligns with your risk tolerance and financial objectives. Stay updated on the latest analysis from sources like BofA and other reputable financial institutions to navigate the market effectively.

Featured Posts

-

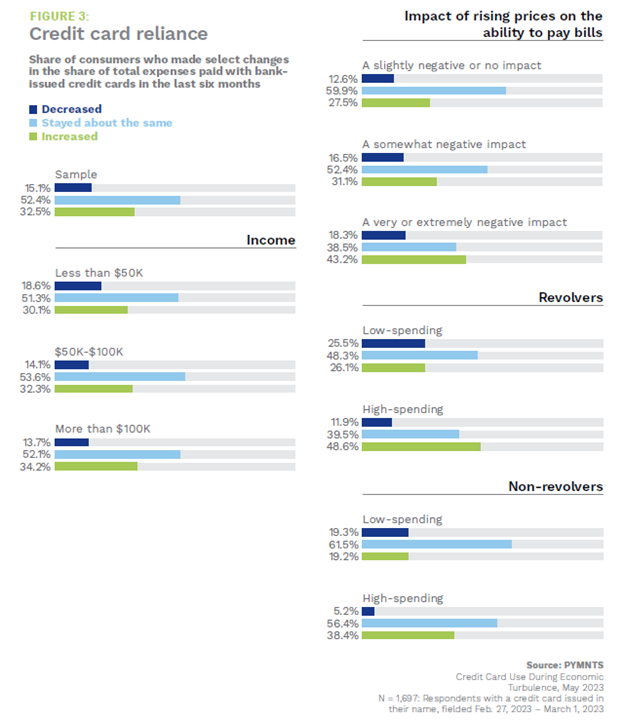

Credit Card Industry Impacts The Fallout From Reduced Non Essential Spending

Apr 24, 2025

Credit Card Industry Impacts The Fallout From Reduced Non Essential Spending

Apr 24, 2025 -

Understand The Liberal Platform A Voters Guide By William Watson

Apr 24, 2025

Understand The Liberal Platform A Voters Guide By William Watson

Apr 24, 2025 -

The Impact Of Reduced Consumer Spending On The Credit Card Market

Apr 24, 2025

The Impact Of Reduced Consumer Spending On The Credit Card Market

Apr 24, 2025 -

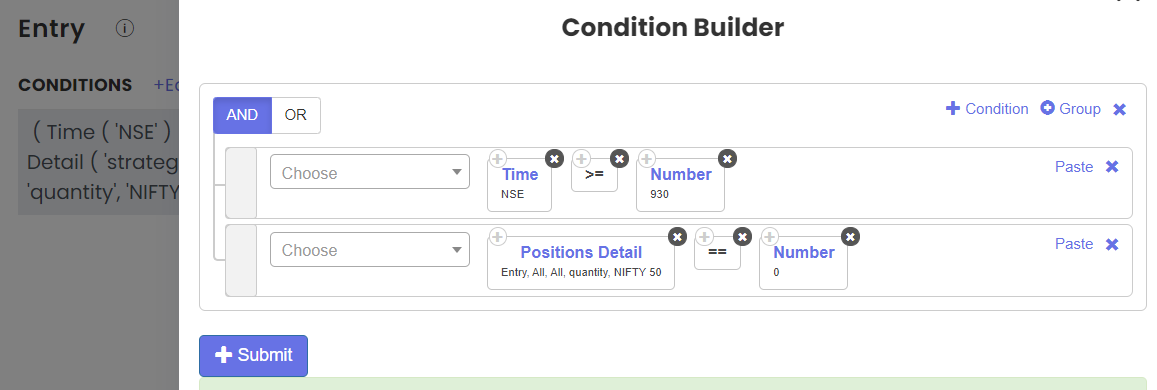

Analyzing Indias Nifty Current Market Trends And Growth Drivers

Apr 24, 2025

Analyzing Indias Nifty Current Market Trends And Growth Drivers

Apr 24, 2025 -

Alcons Stalking Horse Bid For Village Roadshow Approved 417 5 Million Deal Secured

Apr 24, 2025

Alcons Stalking Horse Bid For Village Roadshow Approved 417 5 Million Deal Secured

Apr 24, 2025