The Distributional Effects Of Trump's Economic Policies

Table of Contents

Tax Cuts and Their Impact

The cornerstone of Trump's economic platform was the 2017 Tax Cuts and Jobs Act (TCJA). This legislation significantly altered the American tax code, resulting in a complex and far-reaching set of distributional consequences.

The 2017 Tax Cuts and Jobs Act

The TCJA reduced both corporate and individual income tax rates. While proponents argued this would stimulate economic growth, critics pointed to the disproportionate benefits accruing to high-income earners.

- Reduced individual income tax rates across the board: While all income brackets saw a reduction, the percentage reductions were often larger for higher earners, leading to a widening of the income gap.

- Significant corporate tax rate reduction from 35% to 21%: This dramatic cut was intended to boost business investment and job creation. However, the effect on job growth remains a subject of ongoing debate.

- Increased standard deduction: This measure provided some tax relief to lower-income individuals, but its overall impact on inequality is debated.

The long-term economic effects of the TCJA remain a subject of intense scrutiny. The substantial increase in the national debt due to reduced tax revenue is a significant concern. Furthermore, the debate continues regarding whether the tax cuts ultimately exacerbated income inequality or stimulated sufficient economic growth to offset this effect. Analyzing the distributional effects of Trump's tax policies requires considering both short-term benefits and potential long-term economic risks.

Impact on Investment and Job Creation

A central argument in favor of the TCJA was its potential to stimulate investment and job creation. While corporate profitability increased following the tax cuts, evidence of significant job creation remains mixed.

- Increased corporate profitability, but limited evidence of significant job creation: While companies saw increased profits, much of this was used for stock buybacks rather than investments in new equipment, facilities, or hiring.

- Stock market performance during this period: The stock market experienced significant growth following the tax cuts, benefiting investors disproportionately. This further highlights the uneven distribution of benefits.

- Wage growth analysis across different income groups: While wage growth occurred, it was not uniformly distributed, with lower-income workers experiencing less significant gains than higher-income earners.

The relationship between tax cuts, investment, and job creation remains a complex issue, and analyzing the specific distributional effects of Trump's economic policies on employment requires careful consideration of various factors.

Trade Policies and Their Consequences

Trump's administration implemented significant changes to US trade policy, characterized by protectionist measures such as tariffs. These policies had profound and uneven distributional effects of Trump's economic policies.

Tariffs and Trade Wars

The imposition of tariffs on goods from China and other countries led to increased prices for imported goods, impacting consumers and businesses alike.

- Increased prices for imported goods, affecting consumers: Tariffs directly increased the cost of certain goods, disproportionately affecting low- and middle-income consumers who spend a larger percentage of their income on essential goods.

- Negative impacts on industries reliant on international trade: Industries heavily reliant on imports faced increased costs, leading to reduced competitiveness and in some cases, job losses.

- Retaliatory tariffs from other countries: The imposition of US tariffs prompted retaliatory measures from other nations, further disrupting international trade and impacting various sectors of the US economy.

The distributional effects of Trump's trade policies were far-reaching and complex, highlighting the interconnectedness of the global economy and the potential for unintended consequences from protectionist measures.

Impact on Different Sectors and Workers

The effects of Trump's trade policies varied significantly across different economic sectors.

- Impact on farmers due to trade disputes with China: The agricultural sector was particularly vulnerable to retaliatory tariffs, leading to significant financial losses for many farmers.

- Effects on manufacturing jobs: While some manufacturing jobs might have been preserved or created by tariffs, the overall impact on manufacturing employment remains debated.

- Shifts in employment within the service sector: The service sector, less directly impacted by tariffs, saw varying effects depending on its linkages to manufacturing and international trade.

Regulatory Changes and their Distributional Effects

The Trump administration pursued a significant deregulation agenda, rolling back environmental and financial regulations. These changes had substantial distributional effects of Trump's economic policies.

Deregulation and its Consequences

The rollback of environmental regulations raised concerns about environmental justice, particularly impacting low-income communities and communities of color who often bear a disproportionate burden of pollution.

- Impact of relaxed environmental standards on low-income communities: Weakening environmental regulations often leads to increased pollution and health risks in areas with lower socioeconomic status.

- Potential risks to the financial system from reduced regulation: Reduced financial regulation raises concerns about the stability of the financial system and the potential for future crises that could have wide-ranging economic consequences.

- Increased pollution and health risks for certain populations: Relaxed environmental standards can lead to higher rates of respiratory illnesses, cancer, and other health problems in vulnerable populations.

Changes in Social Welfare Programs

While not directly related to economic growth, changes to social welfare programs also significantly impact income distribution. Analyzing the distributional effects of Trump's economic policies necessitates examining changes to social safety nets.

- Changes in eligibility requirements for certain programs: Modifications to eligibility criteria for programs such as food stamps or housing assistance can affect access for low-income individuals and families.

- Budgetary impacts on social safety nets: Budget cuts to social programs can exacerbate income inequality and increase poverty rates.

- Effects on different demographic groups (e.g., elderly, disabled): Changes to social welfare programs can disproportionately affect certain demographic groups, potentially leading to increased hardship and inequality.

Conclusion

Analyzing the distributional effects of Trump's economic policies reveals a complex and uneven impact across different segments of the American population. Tax cuts primarily benefited high-income earners, while trade policies and deregulation disproportionately affected specific industries and vulnerable communities. The effects on employment, income inequality, and the national debt remain subjects of ongoing debate and further research.

Further research is crucial to fully understand the long-term consequences of the distributional effects of Trump's economic policies. Analyzing further data and exploring the interaction between these policies and other socioeconomic factors will be essential to inform future economic policymaking and address the persistent inequalities highlighted in this analysis. A comprehensive understanding of the distributional effects of Trump's economic policies is vital for crafting effective future economic strategies.

Featured Posts

-

New Ev Technology Collaboration Saudi Aramco And Byd Join Forces

Apr 22, 2025

New Ev Technology Collaboration Saudi Aramco And Byd Join Forces

Apr 22, 2025 -

Pentagon Chaos Claims And Signal Chat Controversy Surround Hegseth

Apr 22, 2025

Pentagon Chaos Claims And Signal Chat Controversy Surround Hegseth

Apr 22, 2025 -

The Future Of Nordic Defense Collaboration Between Sweden And Finland

Apr 22, 2025

The Future Of Nordic Defense Collaboration Between Sweden And Finland

Apr 22, 2025 -

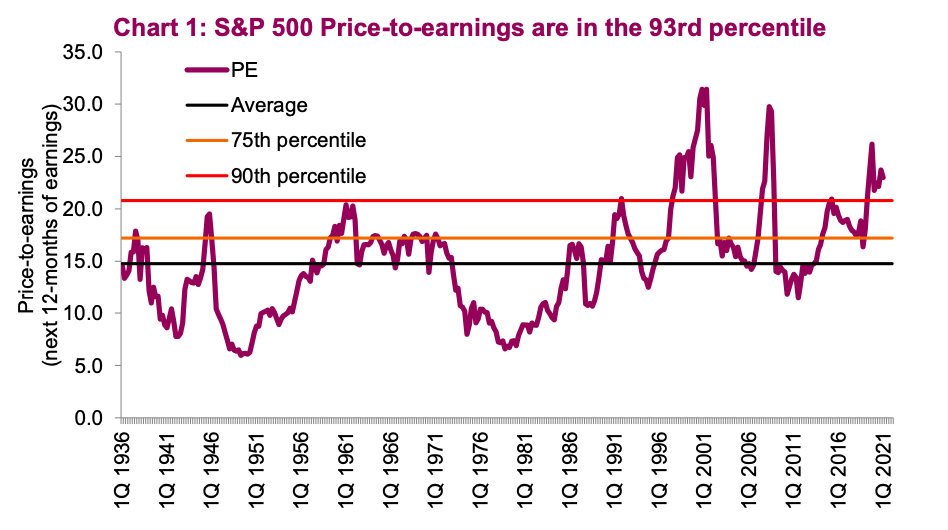

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025 -

Us Protests Against Trump Voices From Across The Nation

Apr 22, 2025

Us Protests Against Trump Voices From Across The Nation

Apr 22, 2025