Tesla Q1 2024 Financial Results: Significant Net Income Decrease

Table of Contents

Declining Profit Margins: Price Wars and Increased Competition

Tesla's Q1 2024 earnings report highlighted a sharp decrease in profit margins, a direct consequence of escalating price wars and the increasingly competitive EV landscape. The relentless pressure to maintain market share has forced Tesla to engage in aggressive price reductions, impacting profitability significantly.

-

Impact of Price Wars: The intense competition has triggered a price war within the EV market, forcing Tesla to lower prices on several of its models, including the Model 3 and Model Y, to remain competitive. This strategy, while crucial for market share, has directly impacted profit margins.

-

Increased Competition from Other EV Manufacturers: The emergence of strong competitors like BYD, Volkswagen, and others offering comparable EVs at increasingly competitive prices, has significantly narrowed Tesla’s advantage. These competitors are leveraging economies of scale and innovative technologies to challenge Tesla's dominance.

-

Specific Examples:

- Profit margins decreased by [insert percentage]%, according to the Q1 2024 report.

- BYD's aggressive pricing strategy in key markets like China has directly impacted Tesla's sales.

- Tesla implemented price cuts averaging [insert percentage]% on its Model 3 and Model Y vehicles.

- [Include a chart or graph illustrating the decline in profit margins and competitor market share gains].

Rising Production Costs and Supply Chain Challenges

The surge in production costs played a substantial role in Tesla's Q1 2024 net income decrease. Inflation, coupled with persistent supply chain disruptions, has significantly increased the cost of raw materials and manufacturing.

-

Inflation and Supply Chain Disruptions: Global inflation has driven up the cost of everything from labor to energy, impacting Tesla's bottom line. Simultaneously, ongoing supply chain challenges, particularly concerning raw materials crucial for battery production, further exacerbated the situation.

-

Raw Material Price Fluctuations: Fluctuations in the prices of lithium, nickel, and other critical battery components have created significant volatility in Tesla's production costs. The unpredictable nature of these prices makes accurate cost forecasting difficult.

-

Specific Examples:

- The cost of lithium carbonate, a key battery component, increased by [insert percentage]% in Q1 2024.

- Supply chain bottlenecks resulted in [insert data on delays or production shortfalls].

- Tesla is exploring alternative sourcing strategies and investing in vertical integration to mitigate supply chain risks.

Increased Spending on R&D and Expansion

Tesla's significant investments in research and development (R&D) and expansion of its manufacturing capabilities, while essential for long-term growth, have impacted short-term profitability.

-

Investments in R&D: Tesla continues to invest heavily in the development of new technologies, including advancements in autonomous driving (Full Self-Driving), battery technology, and new vehicle designs. This commitment to innovation requires substantial financial resources.

-

Expanding Manufacturing Facilities (Gigafactories): The construction and operation of new Gigafactories worldwide represent a significant capital expenditure. While vital for increasing production capacity and global reach, these investments strain short-term financial performance.

-

Specific Examples:

- Tesla's R&D spending in Q1 2024 reached [insert figure].

- The Berlin Gigafactory is ramping up production, incurring substantial initial costs.

- The long-term strategic value of these investments is expected to outweigh the short-term financial impact.

Impact on Tesla Stock and Investor Sentiment

The Q1 2024 financial results triggered a negative reaction in the market, significantly impacting Tesla's stock price and investor sentiment.

-

Market Reaction: The announcement of the significant net income decline caused a [insert percentage]% drop in Tesla's stock price within [timeframe].

-

Analyst Ratings and Comments: Many analysts revised their ratings and forecasts for Tesla following the earnings report, reflecting concerns about the company's profitability and future growth.

-

Investor Concerns and Future Outlook: Investors expressed concern about the intensifying competition, rising costs, and the impact of price cuts on future profitability. The long-term outlook, however, remains a subject of debate among investors.

Analyzing the Tesla Q1 2024 Net Income Decrease – What's Next?

Tesla's significant Q1 2024 net income decline stems from a confluence of factors: intensified price wars, rising production costs, and substantial investments in future growth. The company faces significant challenges in navigating the increasingly competitive EV landscape while maintaining profitability. While there are concerns regarding short-term performance, Tesla's long-term prospects depend on its ability to successfully manage these challenges, innovate, and maintain its market leadership. The future will likely see a continued focus on cost optimization, supply chain diversification, and maintaining the pace of innovation.

To stay informed about future Tesla financial results and developments in the EV market, subscribe to our updates or follow reputable news sources. [Link to relevant page/news source]. Understanding the fallout from the Tesla Q1 2024 earnings is crucial for investors and anyone interested in the future of the EV industry.

Featured Posts

-

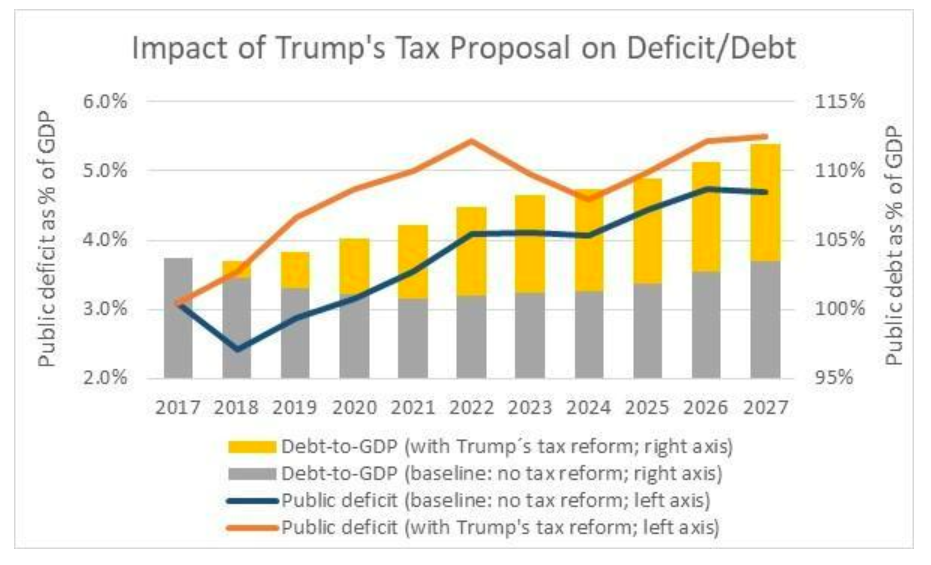

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Hong Kongs Chinese Stock Market Sees Gains As Trade Worries Subside

Apr 24, 2025

Hong Kongs Chinese Stock Market Sees Gains As Trade Worries Subside

Apr 24, 2025 -

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025

Key Bench Players Hield And Payton Secure Warriors Win Against Blazers

Apr 24, 2025 -

Sharks And Tragedy Recent Events At An Israeli Beach

Apr 24, 2025

Sharks And Tragedy Recent Events At An Israeli Beach

Apr 24, 2025 -

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

Apr 24, 2025

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

Apr 24, 2025