PFC's Action Against Gensol Promoters: EoW Transfer Blocked Over False Documents

Table of Contents

The Gensol EoW Transfer and its Suspension

Details of the Proposed EoW Transfer

Gensol, a [insert company sector] company, proposed an Employee Ownership (EoW) transfer involving a significant number of its shares. This transfer, intended to [state the intended outcome of the EoW transfer, e.g., restructure ownership, reward employees, etc.], involved [specify number] shares, representing approximately [percentage]% of the company's outstanding equity. The proposed valuation of these shares was [state the valuation, if available]. The transfer was to be executed through [explain the proposed mechanism for the transfer].

- EoW Transfer Process: An EoW transfer typically involves a detailed valuation process, regulatory approvals, and adherence to strict guidelines set by SEBI and other relevant regulatory bodies.

- Timeline: The proposed EoW transfer was scheduled to be completed by [mention the original completion date].

- Regulatory Approvals: Securing necessary approvals from SEBI and other regulatory bodies is a crucial step in any EoW transfer process, ensuring compliance and transparency.

PFC's Investigation and Findings of False Documents

The Allegations of Fraud

The PFC launched an investigation into the Gensol EoW transfer after receiving [mention the source of complaint, e.g., anonymous tip, internal whistleblower]. The investigation revealed alleged discrepancies and inconsistencies within the documents submitted by Gensol's promoters to support the proposed transfer. These discrepancies raise concerns about the authenticity and accuracy of information provided to regulatory bodies. The PFC's findings suggest the possibility of intentional misrepresentation and fraudulent activities.

- Type of Falsified Documents: Allegedly falsified documents include [specify types of documents, e.g., financial statements, valuation reports, employee shareholding records]. The PFC’s investigation highlights the potential manipulation of key financial data to inflate the share valuation.

- Evidence Uncovered: The PFC's investigation uncovered [mention specific evidence found, e.g., conflicting financial records, discrepancies in employee records, witness testimonies]. This evidence significantly strengthens the case against the promoters.

- Impact on EoW Transfer: The alleged falsification of documents directly jeopardized the integrity of the EoW transfer, rendering the entire process suspect and necessitating its immediate suspension.

Implications for Gensol and its Promoters

Potential Penalties and Sanctions

The PFC's action against Gensol's promoters carries significant implications. The consequences could range from substantial financial penalties and reputational damage to potential legal action and even delisting from the stock exchanges. The investigation’s findings could also trigger further investigations by other regulatory bodies, leading to even more severe penalties.

- Legal Actions: The promoters may face criminal charges related to fraud, misrepresentation, and violation of securities laws. Civil lawsuits from aggrieved investors are also a distinct possibility.

- Impact on Stock Price and Investor Confidence: The PFC's action has already negatively impacted Gensol's stock price. Investor confidence in the company is significantly eroded, potentially leading to further losses and difficulties in raising capital.

- Further Investigations: Other regulatory bodies, including SEBI, may initiate their own investigations based on the PFC's findings, potentially expanding the scope and severity of the consequences.

The Broader Impact on the Securities Market

Strengthening Regulatory Oversight

The Gensol case underscores the crucial role of robust regulatory oversight in preventing fraudulent activities within the securities market. The swift action taken by the PFC serves as a strong deterrent against such practices. It also highlights the need for greater transparency and stricter enforcement of existing regulations.

- Similar Cases: This case echoes past instances of fraudulent activities in the Indian stock market, reinforcing the persistent need for vigilance and strengthened regulatory measures.

- Transparency and Accountability: Increased transparency in corporate governance and improved mechanisms for holding promoters accountable are essential to building investor trust and ensuring a healthy securities market.

- Investor Due Diligence: Investors must exercise greater due diligence when making investment decisions. Thorough research and careful scrutiny of corporate disclosures are vital in mitigating investment risks.

Conclusion

The PFC's intervention in the Gensol EoW transfer, prompted by the discovery of allegedly false documents submitted by the promoters, has far-reaching implications. The blocking of the transfer highlights the importance of regulatory scrutiny and the severe consequences of fraudulent activities in the securities market. This case serves as a stark reminder of the need for vigilance and due diligence in all aspects of investment. Further investigation into this and similar cases is crucial to protecting investors and upholding market integrity. This Gensol case, with its implications for EoW transfers and corporate governance, demands careful attention from investors and regulators alike. Learn more about protecting yourself from investment fraud and understanding the complexities surrounding EoW transfers and other corporate actions.

Featured Posts

-

Dax Bundestag Elections And Economic Indicators A Complex Interplay

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Complex Interplay

Apr 27, 2025 -

Abu Dhabi Open Belinda Bencics Postpartum Final

Apr 27, 2025

Abu Dhabi Open Belinda Bencics Postpartum Final

Apr 27, 2025 -

The Perfect Couple Season 2 New Cast And Source Material Unveiled

Apr 27, 2025

The Perfect Couple Season 2 New Cast And Source Material Unveiled

Apr 27, 2025 -

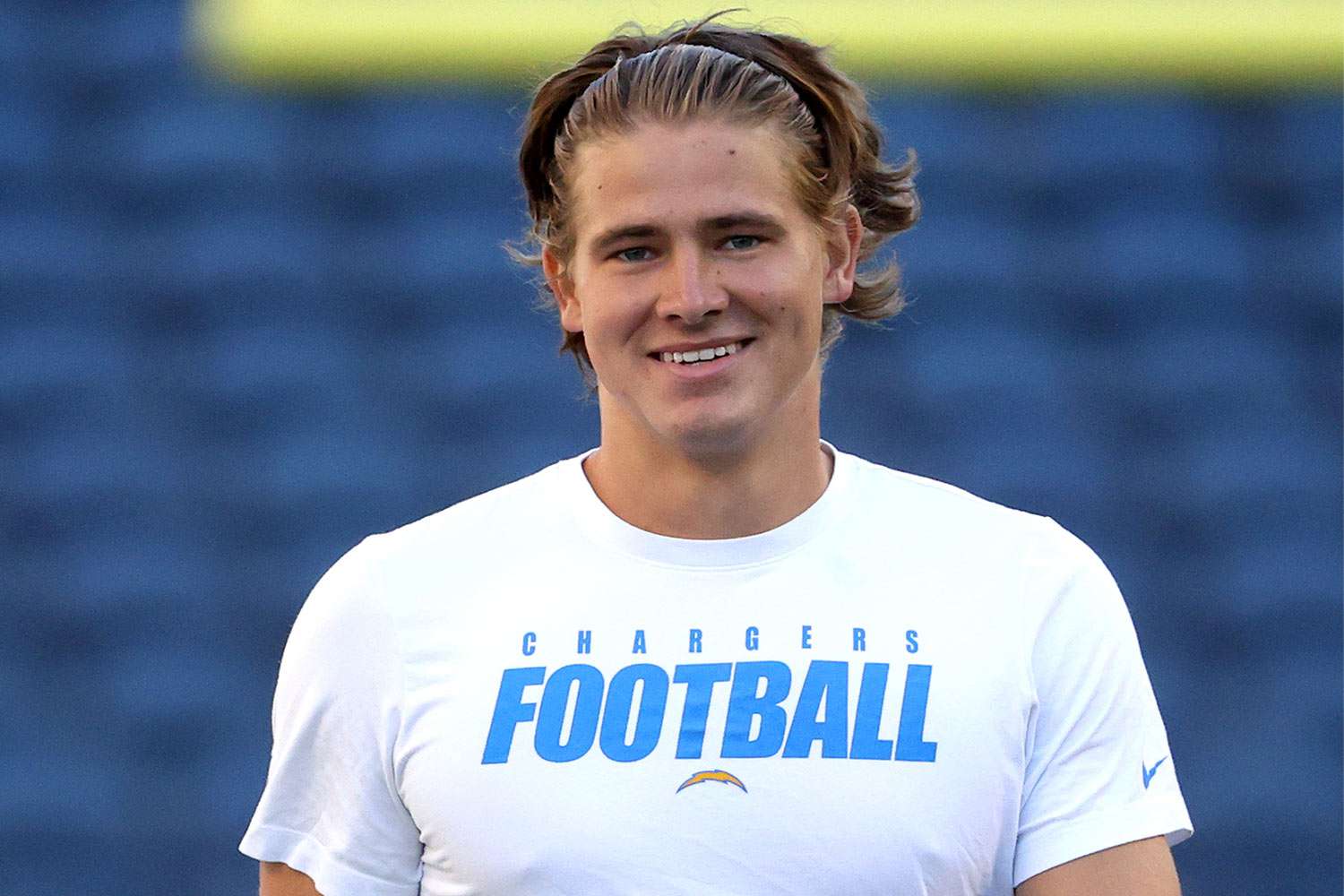

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

Private Credits Widening Cracks Signs Of Distress Before The Market Turmoil

Apr 27, 2025

Private Credits Widening Cracks Signs Of Distress Before The Market Turmoil

Apr 27, 2025