Live Stock Market Updates: Dow's 1000-Point Rally Explained

Table of Contents

Economic Indicators and Positive Data

Positive economic news played a significant role in fueling the Dow's 1000-point rally. Several key indicators pointed towards a healthier-than-expected economic outlook, boosting investor confidence.

Inflation Cooling Down

The most impactful factor was the cooling of inflation. Lower-than-anticipated Consumer Price Index (CPI) figures signaled that inflationary pressures were easing.

- Lower CPI figures: Recent CPI reports showed a significant decrease in inflation compared to previous months. This suggests the Federal Reserve's aggressive interest rate hikes are starting to have the desired effect.

- Easing concerns about aggressive Federal Reserve interest rate hikes: The cooling inflation alleviated fears of further, drastic interest rate increases from the Federal Reserve, a move that would generally stifle economic growth.

- Positive impact on consumer spending: With inflation easing, consumers feel more confident about spending, leading to increased demand and boosting corporate profits. For instance, data from the U.S. Department of Commerce shows a steady increase in retail sales.

Strong Employment Numbers

Robust job growth figures added to the positive economic narrative. Strong employment data indicates a healthy economy capable of sustaining growth.

- Unemployment rate: The unemployment rate remained low, demonstrating a strong labor market. This suggests a healthy economy with ample opportunities and high consumer confidence.

- Job creation figures: The number of jobs created exceeded expectations in recent months, reinforcing the positive economic outlook. Data released by the Bureau of Labor Statistics confirms this trend.

- Impact on consumer confidence and spending: High employment rates lead to increased consumer confidence and spending, creating a virtuous cycle of economic growth.

Positive Corporate Earnings Reports

Strong earnings reports from major corporations further fueled the rally. Exceeding expectations, many companies announced impressive financial results, strengthening investor sentiment.

- Examples of companies with positive earnings: Several key companies across diverse sectors reported significant profit increases, highlighting broad-based economic strength. Specific examples can be found in major financial news outlets like the Wall Street Journal and Bloomberg.

- Sectors showing strong performance: The technology, consumer discretionary, and industrial sectors demonstrated particularly strong performance, signaling robust overall economic activity.

- Impact on investor sentiment: Positive corporate earnings reports boosted investor confidence, driving further investment in the stock market and contributing to the upward trend.

Geopolitical Factors and Market Sentiment

Beyond economic indicators, geopolitical factors and overall market sentiment played a crucial role in the Dow's remarkable surge.

Easing Geopolitical Tensions

A reduction in global uncertainty contributed significantly to the rally. Easing tensions in certain geopolitical hotspots led to increased investor confidence.

- Specific geopolitical events or de-escalations: While specific events vary, a general lessening of international tensions often creates a more stable environment for investment. Major news outlets provide regular updates on such events.

- Their impact on market stability: Reduced geopolitical risk generally translates to a more stable market, encouraging investors to take on more risk.

- Investor reaction: Investors often react positively to a decrease in geopolitical uncertainty, leading to increased investment and higher stock prices.

Improved Investor Confidence

Rising investor confidence was a key driver of the market's upward trajectory. Several factors contributed to this improved sentiment.

- Factors influencing improved confidence: The combination of positive economic data and easing geopolitical tensions significantly boosted investor confidence.

- Changes in investor behavior (e.g., increased buying): Investors responded to the positive news by increasing their investments, fueling the rally.

- Impact on market liquidity: Increased investor participation improved market liquidity, making it easier for buyers and sellers to transact, further accelerating the price increase. Increased trading volume confirms this.

Technical Analysis and Market Dynamics

Technical analysis, focusing on market trends and momentum, provides further insights into the Dow's 1000-point rally.

Technical Indicators

Technical indicators played a crucial role in predicting and confirming the upward trend. These indicators provided signals suggesting a strong bull market.

- Explain key technical signals that supported the upward trend: Moving averages, Relative Strength Index (RSI), and other indicators showed clear signs of a sustained upward trend. Charts and graphs are essential for illustrating these signals.

- Use charts and graphs to illustrate these technical indicators: Visual representations of technical indicators can provide a clear picture of the market's momentum.

Short Covering and Market Momentum

Short covering and market momentum significantly amplified the rally.

- Explain the mechanics of short-covering: Short-selling involves borrowing and selling shares, hoping to buy them back later at a lower price. When prices rise unexpectedly, short-sellers are forced to buy back shares to limit their losses ("covering"), driving prices even higher.

- How it contributes to rapid price increases: This collective buying action can drastically accelerate price increases, creating a self-reinforcing upward spiral.

- The impact of positive market momentum: The combination of positive news and short covering generated substantial market momentum, leading to the dramatic 1000-point surge.

Conclusion: Understanding the Dow's 1000-Point Rally and Future Outlook - Live Stock Market Updates

The Dow's 1000-point rally resulted from a confluence of factors: positive economic indicators, easing geopolitical tensions, and powerful market dynamics. Cooling inflation, robust employment numbers, strong corporate earnings, and improved investor confidence all contributed to this significant upward movement. Technical indicators like moving averages and the impact of short covering further amplified the rally.

While the outlook remains positive, investors should remain aware of potential risks and opportunities. Staying informed about live stock market updates is crucial for making informed investment decisions. Use reliable sources to monitor the Dow Jones Industrial Average performance and understand stock market trends and market volatility. Regularly reviewing economic data, geopolitical events, and market analysis will help you navigate the ever-changing landscape of the stock market. Stay informed – your financial future depends on it.

Featured Posts

-

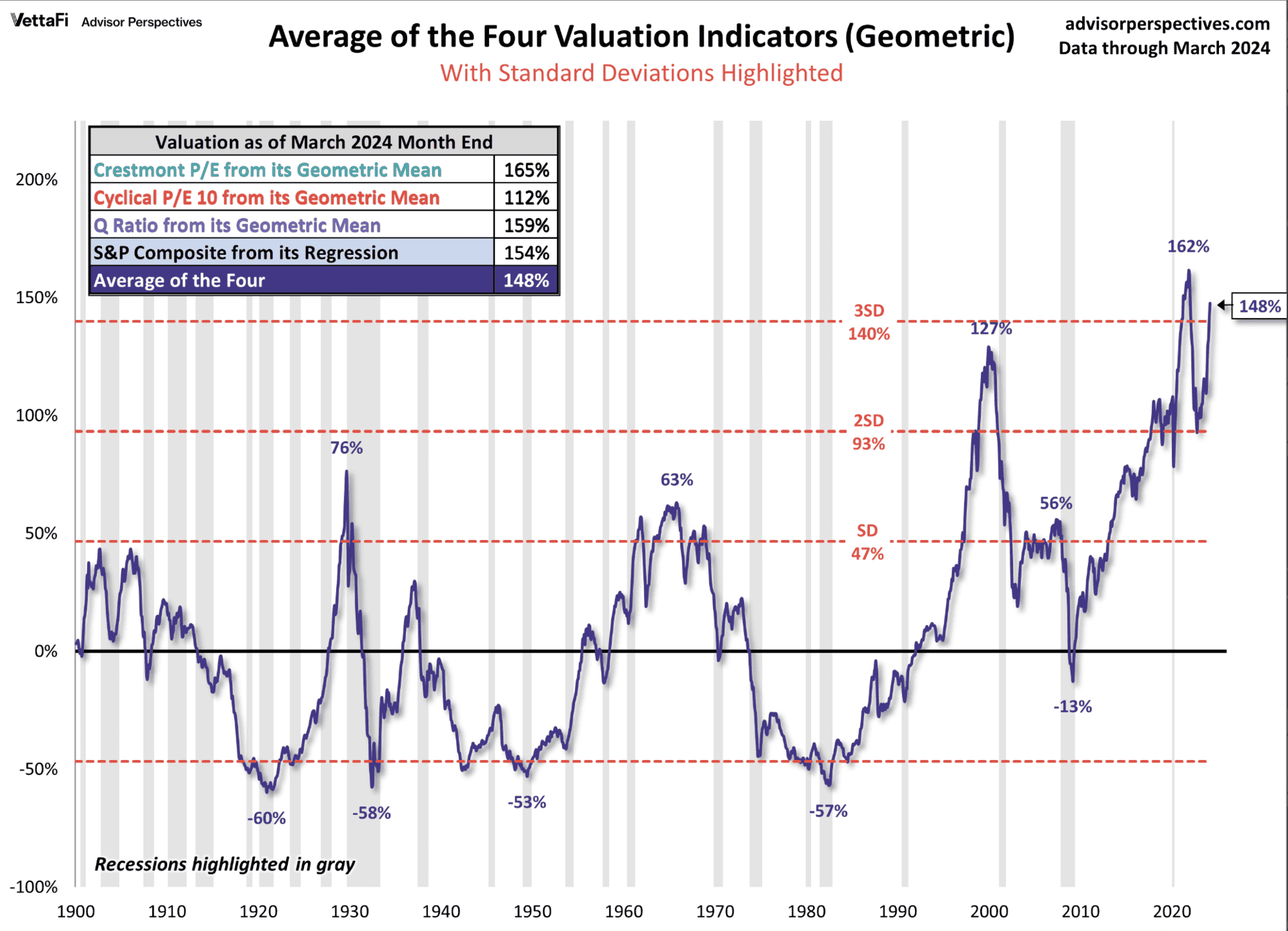

Are High Stock Market Valuations Cause For Concern Bof A Says No

Apr 24, 2025

Are High Stock Market Valuations Cause For Concern Bof A Says No

Apr 24, 2025 -

A Citizens Guide To The Liberal Platform William Watsons Perspective

Apr 24, 2025

A Citizens Guide To The Liberal Platform William Watsons Perspective

Apr 24, 2025 -

White House Cocaine Incident Secret Service Investigation Results

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Results

Apr 24, 2025 -

Activision Blizzard Acquisition Ftcs Appeal Against Merger Approval

Apr 24, 2025

Activision Blizzard Acquisition Ftcs Appeal Against Merger Approval

Apr 24, 2025 -

Trumps Influence Fed Policy And Bitcoins Recent Price Increase

Apr 24, 2025

Trumps Influence Fed Policy And Bitcoins Recent Price Increase

Apr 24, 2025