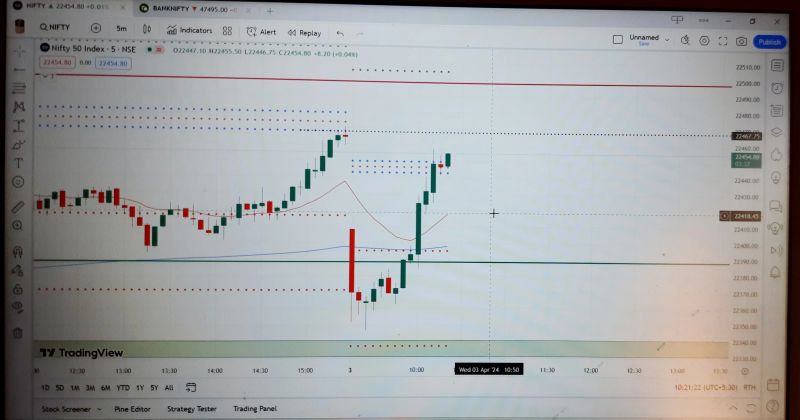

India's Bullish Market: A Deep Dive Into Nifty's Recent Gains

Table of Contents

Factors Fueling Nifty's Rise

Several macroeconomic factors have contributed to Nifty's impressive growth. Analyzing these elements provides crucial insights into the current market dynamics and potential future trajectories. Key drivers include strong economic fundamentals, substantial foreign investment, positive domestic investment, the impact of inflation and interest rates, and a strengthening Rupee.

Strong Economic Fundamentals

India's robust economic growth forms a solid bedrock for the bullish market. The country's GDP has shown consistent growth, fueled by rising consumer confidence and supportive government policies.

- Rising Consumption: Increased disposable incomes and a burgeoning middle class have led to higher consumer spending, boosting demand across various sectors.

- Infrastructure Development: Significant investments in infrastructure projects, including roads, railways, and digital connectivity, are contributing to long-term economic growth.

- Digitalization Initiatives: Government initiatives promoting digitalization are enhancing efficiency and transparency across sectors, fostering economic expansion.

- Government Reforms: Pro-business reforms and deregulation are creating a more conducive environment for investment and economic activity. Recent reforms focused on ease of doing business have significantly improved the investment climate.

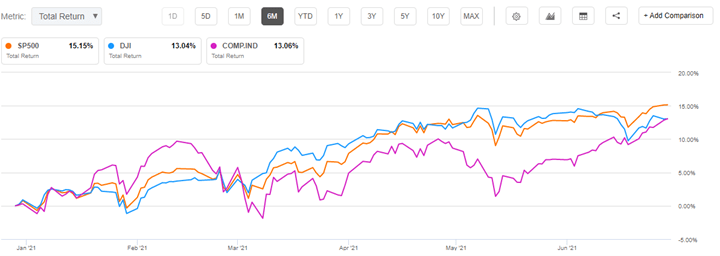

Influx of Foreign Investment

Foreign Institutional Investors (FIIs) have played a significant role in Nifty's rise. Increased FII inflows reflect growing confidence in the Indian economy's potential.

- FII Inflows: A substantial increase in FII investment has injected significant liquidity into the Indian stock market.

- Reasons for Increased Investment: FIIs are drawn to India's robust growth prospects, relatively young population, and expanding consumer base. The potential for high returns compared to other mature markets is a key attraction.

- Impact on Nifty: The influx of foreign capital has directly fueled the upward trajectory of the Nifty 50 index.

Positive Domestic Investment

Domestic Institutional Investors (DIIs) have also significantly contributed to the market rally, showcasing strong confidence in the domestic economy.

- DII Investments: Mutual funds, pension funds, and other DIIs have actively participated in the market, further bolstering the upward trend.

- Mutual Fund Performance: Strong performance of mutual funds has attracted further investment, creating a positive feedback loop.

- Pension Fund Contributions: Growing pension fund contributions represent a significant and stable source of long-term investment in the Indian stock market.

Impact of Inflation and Interest Rates

While inflation and interest rates can impact market performance, the Reserve Bank of India (RBI) has managed these factors effectively, supporting continued market growth.

- Inflation Levels: While inflation has been a concern, the RBI's proactive measures have largely kept it within manageable levels.

- RBI Policy: The RBI's monetary policy has struck a balance between controlling inflation and supporting economic growth.

- Interest Rate Impact on Investment Decisions: Interest rate adjustments have influenced investment decisions, but the overall impact on the Nifty has remained largely positive.

Rupee Strength

The relatively strong Indian Rupee against other major currencies has further enhanced the attractiveness of the Indian stock market to foreign investors.

- Rupee Exchange Rate: A stable and relatively strong Rupee has boosted investor confidence.

- Impact on Foreign Investment Returns: A stronger Rupee translates to higher returns for foreign investors when converting their profits back into their home currencies.

- Investor Confidence: The stability of the Rupee contributes positively to the overall investor sentiment, encouraging further investment.

Sector-Specific Performance within Nifty

Analyzing the performance of different sectors within the Nifty 50 index offers a more granular view of the market's health and potential future trends.

Technology Sector Boom

The IT sector has been a significant contributor to Nifty's gains, driven by global demand and digital transformation.

- Growth Drivers: Increased global demand for IT services and the ongoing digital transformation across various industries have fueled the sector's growth.

- Leading IT Companies' Performance: Leading Indian IT companies have reported strong financial results, reflecting the sector's robust performance.

Banking Sector Strength

The banking sector's improved performance has also played a vital role in the overall market uptrend.

- Loan Growth: Healthy loan growth indicates increasing economic activity and credit availability.

- Asset Quality: Improvements in asset quality demonstrate greater stability and reduced risk within the banking sector.

- Banking Reforms: Government initiatives to strengthen and regulate the banking sector have instilled greater confidence.

- Top Performing Banks: Several leading Indian banks have shown excellent performance, contributing significantly to the Nifty's gains.

FMCG Sector Resilience

The FMCG sector has displayed remarkable resilience, reflecting the continued strength of consumer spending.

- Consumer Spending: Consistent consumer spending, despite inflationary pressures, highlights the underlying strength of the Indian economy.

- Demand Trends: Demand for FMCG products remains robust, demonstrating the resilience of the sector.

- Leading FMCG Companies: Leading FMCG companies have reported strong sales and earnings, contributing to the overall market positivity.

Other Notable Sectors

Other key sectors within the Nifty 50, such as infrastructure, pharmaceuticals, and energy, have also contributed to the overall market performance, though perhaps to a lesser extent than the sectors discussed above.

Risks and Challenges Ahead

While the current outlook for the Indian stock market is positive, several risks and challenges could impact the bullish trend. Understanding and managing these risks is crucial for informed investment decisions.

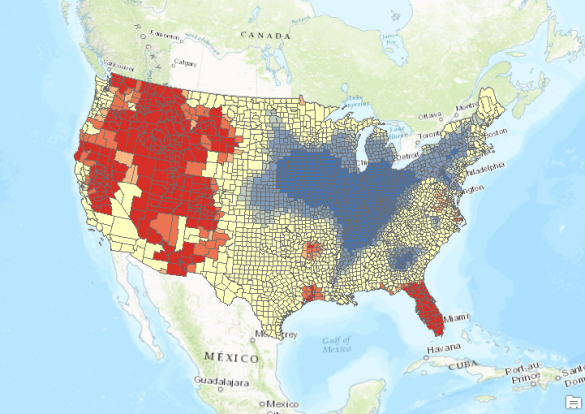

Global Economic Uncertainty

Global economic slowdowns or recessions could negatively impact the Indian market, particularly given its increasing integration into the global economy.

- Global Inflation: High global inflation can affect commodity prices and potentially dampen economic growth in India.

- Supply Chain Disruptions: Global supply chain disruptions can impact businesses and hinder economic growth.

- Geopolitical Tensions: Geopolitical instability can create uncertainty and negatively affect investor sentiment.

Market Corrections

Short-term market corrections are a normal part of the market cycle. Investors should be prepared for periods of volatility.

- Market Volatility: Expect some degree of short-term fluctuations in the market. This volatility is inherent to investing in equities.

- Risk Mitigation Strategies: Investors should employ appropriate risk management strategies to mitigate potential losses during market corrections, such as diversification and stop-loss orders.

Geopolitical Factors

Geopolitical events can significantly influence investor sentiment and market performance. Staying informed about global events is vital.

- International Conflicts: International conflicts can negatively impact investor sentiment and lead to market uncertainty.

- Trade Wars: Trade disputes can disrupt supply chains and affect various sectors of the Indian economy.

- Their Impact on Indian Markets: Geopolitical uncertainties can impact foreign investment flows and overall market confidence.

Conclusion

This article examined the factors driving Nifty's recent impressive gains, highlighting the strong economic fundamentals, influx of foreign investment, and positive domestic sentiment. The strong performance of key sectors like IT and Banking has further contributed to this bullish trend. While the outlook remains largely positive, investors should remain aware of potential risks and challenges, including global economic uncertainty, market corrections, and geopolitical factors. Understanding India's bullish market and the dynamics of Nifty's performance is crucial for informed investment decisions. Stay updated on market trends and consider diversifying your portfolio to manage risk effectively while participating in the exciting opportunities presented by India's thriving stock market. Learn more about investing in India's Bullish Market and the Nifty 50 today!

Featured Posts

-

The Bold And The Beautiful April 16 Liam Hope And Bridgets Day Of Surprises

Apr 24, 2025

The Bold And The Beautiful April 16 Liam Hope And Bridgets Day Of Surprises

Apr 24, 2025 -

The Undervalued Asset How Middle Managers Drive Company Success

Apr 24, 2025

The Undervalued Asset How Middle Managers Drive Company Success

Apr 24, 2025 -

The Dark Side Of Disaster Analyzing Wildfire Betting In Los Angeles

Apr 24, 2025

The Dark Side Of Disaster Analyzing Wildfire Betting In Los Angeles

Apr 24, 2025 -

Dow Jones S And P 500 And Nasdaq Live Market Updates For April 23

Apr 24, 2025

Dow Jones S And P 500 And Nasdaq Live Market Updates For April 23

Apr 24, 2025 -

Tariffs Drive Chinas Lpg Imports A Pivot To The Middle East

Apr 24, 2025

Tariffs Drive Chinas Lpg Imports A Pivot To The Middle East

Apr 24, 2025