Chinese Stocks Jump On Renewed Trade Deal Speculation In Hong Kong

Table of Contents

The Catalyst: Renewed Trade Deal Speculation

Recent reports and whispers of renewed dialogue between US and Chinese officials have ignited speculation about a potential breakthrough in trade negotiations. This follows a period of relative stagnation, leaving investors eager for positive developments.

- Bullet Point 1: Several reputable news outlets, including Bloomberg and the Financial Times, have cited unnamed sources suggesting a potential easing of trade tensions. Furthermore, positive statements from certain government officials have added fuel to the fire.

- Bullet Point 2: The key aspects driving investor confidence center around the possibility of reduced tariffs on Chinese goods and increased market access for US companies. This could significantly boost Chinese exports and stimulate economic growth.

- Bullet Point 3: Historically, US-China trade relations have been marked by periods of tension and cooperation. However, this recent speculation differs from previous instances due to the apparent willingness of both sides to re-engage in serious discussions, offering a glimmer of hope for a more stable and mutually beneficial future.

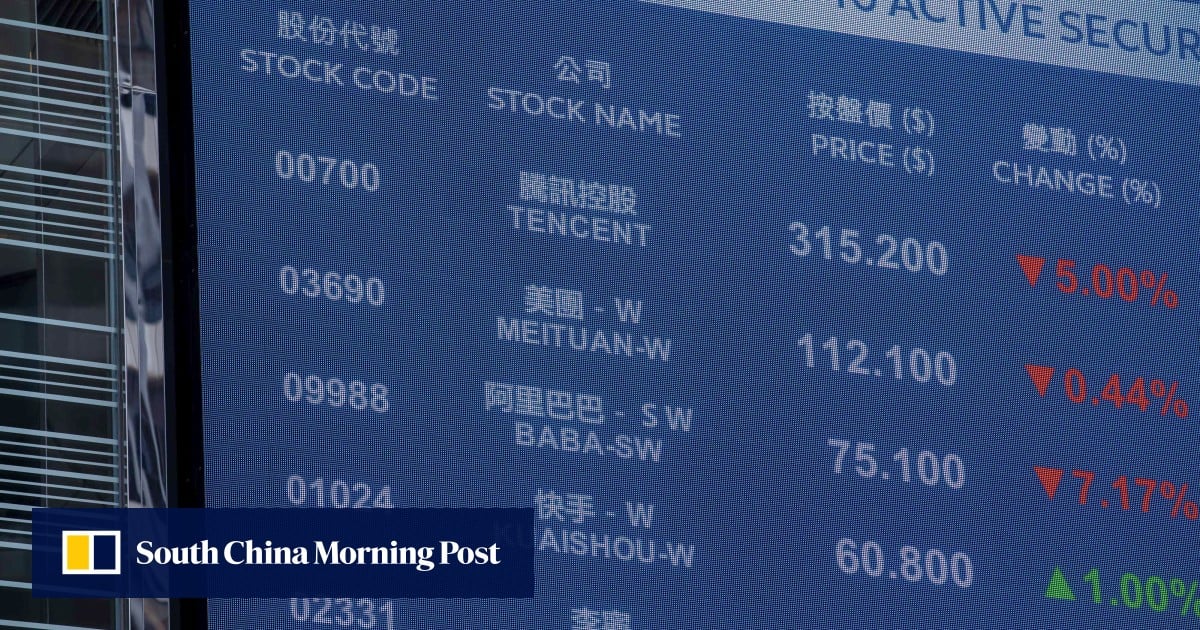

Performance of Key Chinese Stock Sectors

The surge wasn't uniform across the board; certain sectors experienced more significant gains than others. Technology stocks, in particular, witnessed a dramatic rise, along with energy and consumer goods companies.

- Bullet Point 1: Tencent Holdings, a leading technology company, saw its share price jump by X%, while Alibaba Group Holding Limited experienced a Y% increase. Similarly, major energy players like PetroChina saw Z% growth.

- Bullet Point 2: The outperformance of technology stocks can be attributed to the potential for increased demand from the US market following potential tariff reductions. Similarly, reduced import costs could significantly benefit consumer goods companies.

- Bullet Point 3: The potential for further growth in these sectors is substantial, predicated on the successful conclusion of a favorable trade deal. This positive outlook suggests continued investor interest and potential for further price appreciation in the coming months.

Investor Sentiment and Market Volatility

Investor reaction to the renewed trade deal speculation has been overwhelmingly positive, evidenced by a surge in trading volume across Hong Kong's stock exchange.

- Bullet Point 1: Trading volume increased by X% compared to the previous day, highlighting the significant level of investor activity driven by this news.

- Bullet Point 2: Despite the positive sentiment, short-term volatility is expected as investors react to further developments in the trade negotiations. Any setbacks could trigger a swift reversal of the current trend.

- Bullet Point 3: The longer-term implications for investor confidence depend heavily on the actual outcome of the trade negotiations. A successful agreement would significantly bolster confidence in the Chinese market and could attract further foreign investment.

Hong Kong's Role as a Key Financial Hub

Hong Kong's position as a major financial center plays a critical role in facilitating investment in Chinese companies. Its robust regulatory framework and proximity to mainland China make it a strategic gateway for international investors.

- Bullet Point 1: The speculation surrounding the US-China trade deal directly impacted Hong Kong's financial markets, boosting overall trading activity and investor sentiment.

- Bullet Point 2: The potential benefits for Hong Kong include increased financial activity and its cementing of its position as a premier financial hub. However, risks remain, particularly if the trade deal negotiations falter.

Conclusion

The surge in Chinese stocks listed in Hong Kong is primarily attributed to renewed speculation of a US-China trade deal. Key sectors experienced significant gains, reflecting widespread investor optimism. While the potential benefits are substantial, market volatility is anticipated as negotiations progress. Hong Kong, as a crucial financial hub, played a central role in this market movement.

Call to Action: Stay informed about the evolving situation surrounding the US-China trade negotiations and their impact on Chinese stocks in Hong Kong. Monitor market developments closely to capitalize on potential investment opportunities related to Chinese stocks and potential trade deals. Understanding the intricacies of this dynamic relationship is crucial for successful investing in Chinese stocks and navigating the complexities of the global market.

Featured Posts

-

The Bold And The Beautiful Finn Vows To Liam Wednesday April 23 Spoilers

Apr 24, 2025

The Bold And The Beautiful Finn Vows To Liam Wednesday April 23 Spoilers

Apr 24, 2025 -

Auto Dealers Push Back On Mandatory Electric Vehicle Quotas

Apr 24, 2025

Auto Dealers Push Back On Mandatory Electric Vehicle Quotas

Apr 24, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 24, 2025 -

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025

World Economic Forum New Probe Into Klaus Schwabs Leadership

Apr 24, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 24, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 24, 2025